October, 2023

Brazil

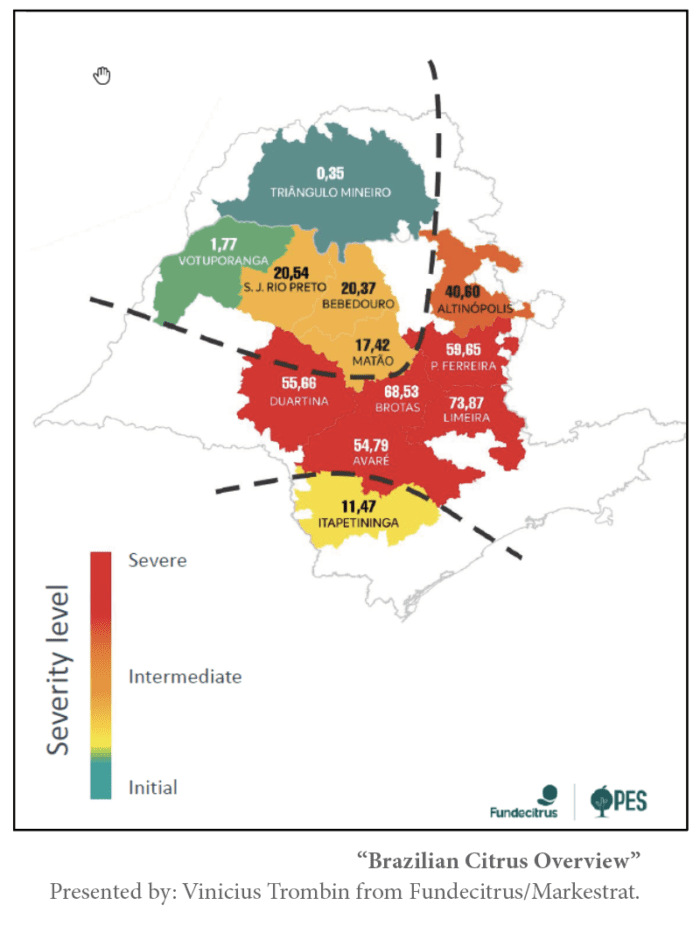

According to the latest “Brazilian Citrus Overview” presentation given by Vinícius Trombin from Fundecitrus/Markestrat at the ICBC Conference, held in Clearwater FL on Sept 20th, 2023, citrus greening (HLB) has become an increasingly difficult problem for farmers to manage within Brazil’s key growing regions.

Greening rates have increased from 24% in 2022 to over 38% in 2023. The citrus belt has been hit especially hard by the increasing intensity, forcing many farmers to move or expand their operations outside their normal territories. As these farming operations reorganize, the overall cost of citrus increases – beyond the initial investment required to expand or construct orchards, the cost of transportation is much higher outside of Brazil’s citrus belt.

Other citrus growers have switched to other, more profitable crops rather than navigate the challenges presented by citrus greening. Popular alternatives to orange production include sugarcane, eucalyptus, and pastures for livestock.

Despite these recent issues, Brazil’s orange production metrics remain unchanged at 309.34 million boxes. There is no carryover from previous seasons, and demand for NFC (not from concentrate) Juice continues to rise. As such, prices for orange oil are expected to remain firm. The crop has been slightly delayed, and new imports are expected to arrive in October.

Mexico

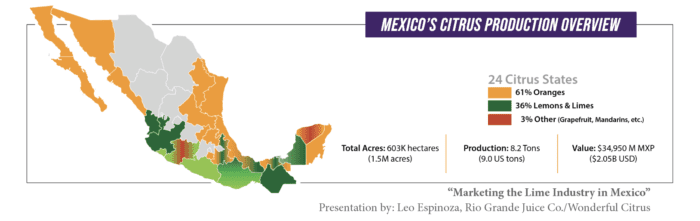

Based on the presentation “Marketing the Lime Industry in Mexico” given by Leo Espinoza from Rio Grande Juice Co. / Wonderful Citrus during the ICBC Conference, the fresh fruit market in Mexico is expected to remain strong. Around 60% of Mexican limes are consumed fresh domestically, while the remaining 27% and 13% is allocated for fresh fruit exports and processing respectively.

Due to the high demand for lime, many farmers in Mexico have started to expand their planting and production operations within key growing regions. However, new lime trees require 2-3 years of maturation before they are ready for harvest. As such, we expect these new planting initiatives to have little to no effect on short-term price fluctuations.

New lime oil out of Mexico will become available in December, as the nation enters its winter crop, though this harvest is significantly smaller than the summer crop and will likely not provide much relief for current demand. Prices for lime oil are expected to remain firm, but it’s quite possible that they have also reached their peak.

Orange production in Mexico typically totals around 5 million MT, as compared to Brazil’s 18.7 million MT. Mexico typically has no carryover for orange oil and always sells out every season, and we currently see no reason that this will not be the case again this year.

Areas reserved for grapefruit production in Mexico have declined 30% this year, as groves were uprooted to make way for sugarcane production. Citrus greening played a role in this decision, as the disease mainly affects oranges and grapefruit. The market for grapefruit oil is expected to begin firming, depending on demand.

Peru

Domestic demand within the fresh fruit market is strong in Peru – 80% of fresh limes are consumed domestically, and very few are exported. However, unlike Mexico, the remaining 20% are allocated for processing juice and oil. Despite this, the volumes produced in Peru are nowhere near what Mexico produces each year.

Due to increasing demand, many growers in Peru have started to expand their production areas, much like in Mexico. These trees take 2-3 years to mature, but recent El Niño forecasts have the potential to disrupt this growing process, as well as other groves around Peru. If the effects of El Niño are moderate, it will likely have little to no effect on lime groves. However, if the effects are severe, then the weather conditions surrounding it have the potential to greatly impact volumes for the upcoming lime season (November – April).

Argentina

Lemon oil production in Argentina has experienced difficulties this year due to a combination of currency inflation and extreme weather conditions. This is the second year in which the blooming period for lemons was interrupted by poor weather, impacting the overall yields for both fresh fruit and processed material. Argentina is now losing ground against competing lemon-producing nations such as Spain and South Africa. Much like Mexico and Peru, Argentina is also converting some of its citrus production to sugarcane, which will likely reduce future yields. As of September 2023, around 6,000 hectares of lemon orchards have been cut and replaced by sugarcane plantations.

Posted In:

Essential Oil Expert - Feature Articles - Market Report - Uncategorized - Argentina Citrus Growing Season - Brazil Citrus Brelt - Brazil Citrus Growing Season - Citrus Greening 2023 - ICBC 2023 - ICBC Recap 2023 - Lemon Oil - Lemon Oil Argentina - Lemon Oil Mexico - Lime Oil Mexican - Lime Oil Mexico - Lime Oil Peru - Mexico Citrus Growing Season - Orange Oil 10x - Orange Oil 5x - Orange Oil Brazil - Orange Oil Mexico - Orange Oil Midseason - Peru Citrus Growing Season